Sarpy County Nebraska Sales Tax Rate . The current total local sales tax rate in sarpy county, ne is 5.500%. Click for sales tax rates, sarpy county sales tax calculator, and printable. sarpy county, ne sales tax rate. sarpy county, nebraska has a maximum sales tax rate of 7.5% and an approximate population of 131,214. current local sales and use tax rates and other sales and use tax information The december 2020 total local. The state sales and use tax. the current sales tax rate in sarpy county, ne is 7.5%. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. the current sales tax rate in 68028, ne is 7.5%. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. This is the total of state, county, and city sales tax rates. find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska.

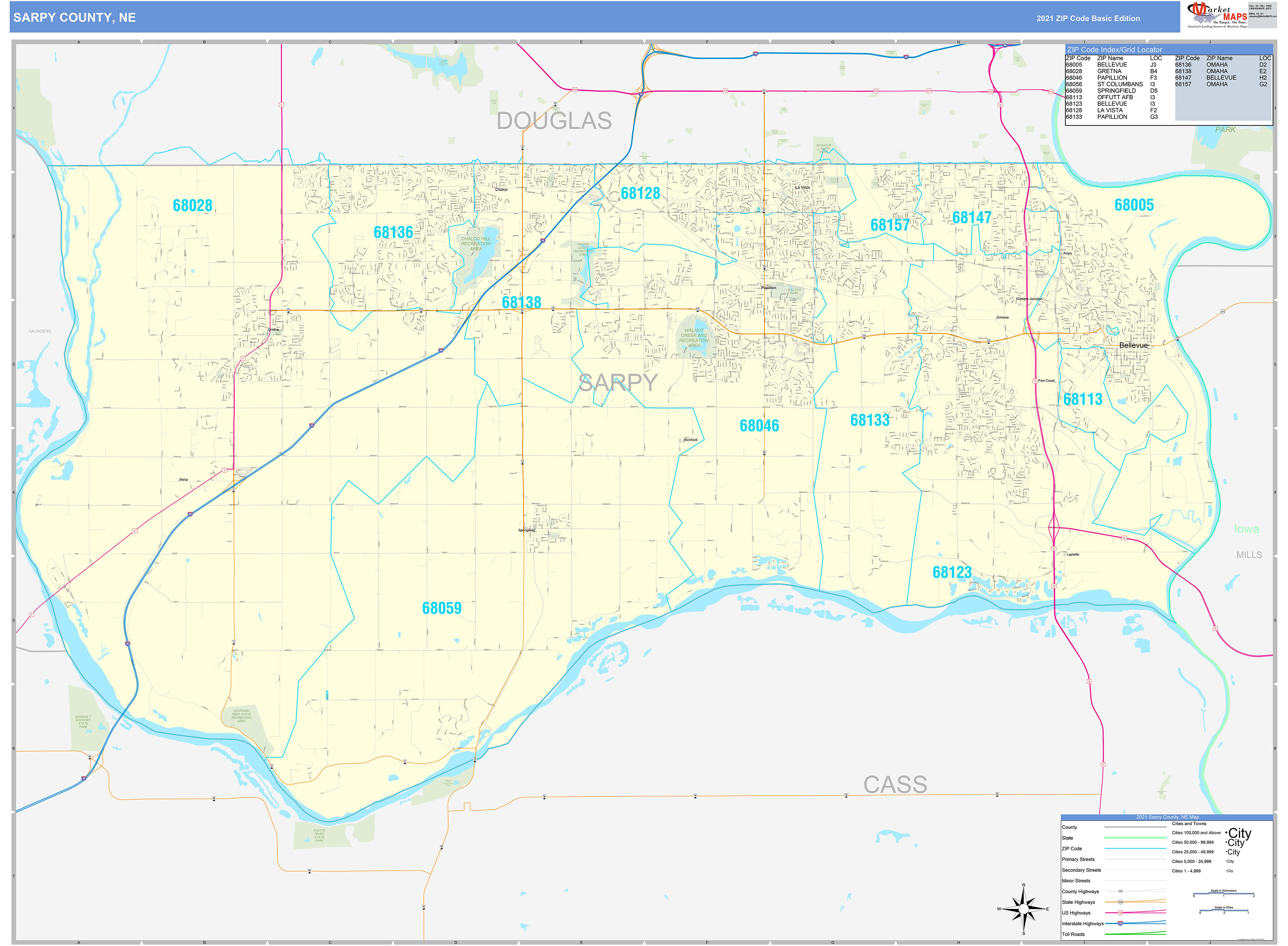

from www.mapsales.com

the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. The december 2020 total local. sarpy county, ne sales tax rate. the current sales tax rate in 68028, ne is 7.5%. current local sales and use tax rates and other sales and use tax information This is the total of state, county, and city sales tax rates. The state sales and use tax. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. sarpy county, nebraska has a maximum sales tax rate of 7.5% and an approximate population of 131,214.

Sarpy County, NE Zip Code Wall Map Basic Style by MarketMAPS MapSales

Sarpy County Nebraska Sales Tax Rate current local sales and use tax rates and other sales and use tax information the current sales tax rate in 68028, ne is 7.5%. Click for sales tax rates, sarpy county sales tax calculator, and printable. sarpy county, nebraska has a maximum sales tax rate of 7.5% and an approximate population of 131,214. find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. the current sales tax rate in sarpy county, ne is 7.5%. This is the total of state, county, and city sales tax rates. current local sales and use tax rates and other sales and use tax information The state sales and use tax. The december 2020 total local. sarpy county, ne sales tax rate. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. The current total local sales tax rate in sarpy county, ne is 5.500%.

From www.wowt.com

Sarpy County property taxes due by July 31 Sarpy County Nebraska Sales Tax Rate the current sales tax rate in 68028, ne is 7.5%. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. the current sales tax rate in sarpy county, ne is 7.5%. current local sales and use tax rates and other sales and use tax information sarpy county, ne sales tax rate. The state. Sarpy County Nebraska Sales Tax Rate.

From old.sermitsiaq.ag

Printable Sales Tax Chart Sarpy County Nebraska Sales Tax Rate the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. the current sales tax rate in sarpy county, ne is 7.5%. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. sarpy county, nebraska has. Sarpy County Nebraska Sales Tax Rate.

From dxoigztcl.blob.core.windows.net

Nebraska Sales Tax By County at Elizabeth Emery blog Sarpy County Nebraska Sales Tax Rate The december 2020 total local. The current total local sales tax rate in sarpy county, ne is 5.500%. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. Click for sales tax rates, sarpy county sales tax calculator, and printable. the minimum combined 2024 sales tax rate. Sarpy County Nebraska Sales Tax Rate.

From formspal.com

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online Sarpy County Nebraska Sales Tax Rate The state sales and use tax. The december 2020 total local. find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. Click for sales tax rates, sarpy county sales tax calculator, and printable. Click for sales tax rates, 68028 sales. Sarpy County Nebraska Sales Tax Rate.

From printablethereynara.z14.web.core.windows.net

North Carolina Sales Tax Rates 2023 Sarpy County Nebraska Sales Tax Rate The december 2020 total local. This is the total of state, county, and city sales tax rates. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. the current sales tax rate in sarpy county, ne is 7.5%. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans. Sarpy County Nebraska Sales Tax Rate.

From almiraychelsey.pages.dev

Sales Tax Calculator 2024 Brit Marney Sarpy County Nebraska Sales Tax Rate Click for sales tax rates, sarpy county sales tax calculator, and printable. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. The current total local sales tax rate in sarpy county, ne is 5.500%.. Sarpy County Nebraska Sales Tax Rate.

From taxcognition.com

Local Sales Tax Rates By Zip Code Top FAQs of Tax Oct2022 Sarpy County Nebraska Sales Tax Rate find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. Click for sales tax rates, sarpy county sales tax calculator, and printable. the current sales tax rate in 68028, ne is 7.5%. current local sales and use tax rates and other sales and use tax information This is the total of. Sarpy County Nebraska Sales Tax Rate.

From printableranchergirllj.z22.web.core.windows.net

Virginia State Tax Tables 2022 Sarpy County Nebraska Sales Tax Rate the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. The current total local sales tax rate in sarpy county, ne is 5.500%. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. Click for sales tax rates, sarpy county sales tax calculator, and printable.. Sarpy County Nebraska Sales Tax Rate.

From printableformsfree.com

Nebraska Fillable Tax Forms Printable Forms Free Online Sarpy County Nebraska Sales Tax Rate This is the total of state, county, and city sales tax rates. The december 2020 total local. Click for sales tax rates, sarpy county sales tax calculator, and printable. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans. Sarpy County Nebraska Sales Tax Rate.

From dxowrytoa.blob.core.windows.net

Sarpy County Ne Property Tax Bill at Stephen White blog Sarpy County Nebraska Sales Tax Rate The state sales and use tax. The december 2020 total local. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. the current sales tax rate in 68028, ne is 7.5%. Click for sales tax rates, sarpy county sales tax calculator, and printable. find the current and upcoming local sales and use tax rates for. Sarpy County Nebraska Sales Tax Rate.

From www.mapsales.com

Sarpy County, NE Zip Code Wall Map Basic Style by MarketMAPS MapSales Sarpy County Nebraska Sales Tax Rate the current sales tax rate in sarpy county, ne is 7.5%. This is the total of state, county, and city sales tax rates. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. The december 2020 total local. The current total local sales tax rate in sarpy county, ne is 5.500%. find the current and. Sarpy County Nebraska Sales Tax Rate.

From kamilawsally.pages.dev

Omaha Ne Sales Tax Rate 2024 Lolly Rachele Sarpy County Nebraska Sales Tax Rate This is the total of state, county, and city sales tax rates. The state sales and use tax. the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. Click for sales tax rates, sarpy county sales tax calculator, and printable. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. sarpy county, ne. Sarpy County Nebraska Sales Tax Rate.

From delaydorella.pages.dev

Tax Rate 2024 Individual Gilly Maryellen Sarpy County Nebraska Sales Tax Rate The state sales and use tax. sarpy county, nebraska has a maximum sales tax rate of 7.5% and an approximate population of 131,214. Click for sales tax rates, sarpy county sales tax calculator, and printable. The current total local sales tax rate in sarpy county, ne is 5.500%. find the current and upcoming local sales and use tax. Sarpy County Nebraska Sales Tax Rate.

From www.realestate.com.au

12534 S 227th Circle, Gretna, NE 68028 Land for Sale Sarpy County Nebraska Sales Tax Rate find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. the current sales tax rate in 68028, ne is 7.5%. The current total local sales tax rate in sarpy county, ne is 5.500%. Click for sales tax rates, sarpy county sales tax calculator, and printable. This is the total of state, county,. Sarpy County Nebraska Sales Tax Rate.

From issuu.com

Sarpy County Chamber of Commerce by Suburban Newspapers Issuu Sarpy County Nebraska Sales Tax Rate the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. sarpy county, ne sales tax rate. Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. The december 2020 total local. current local sales and use tax rates and other sales and use tax information the current sales tax rate in. Sarpy County Nebraska Sales Tax Rate.

From learningschoolhappybrafd.z4.web.core.windows.net

Nc Sales Tax Rates 2022 By County Sarpy County Nebraska Sales Tax Rate the minimum combined 2024 sales tax rate for sarpy, nebraska is 5.5%. the current sales tax rate in 68028, ne is 7.5%. sarpy county, ne sales tax rate. the current sales tax rate in sarpy county, ne is 7.5%. The december 2020 total local. current local sales and use tax rates and other sales and. Sarpy County Nebraska Sales Tax Rate.

From 1stopvat.com

Nebraska Sales Tax Sales Tax Nebraska NE Sales Tax Rate Sarpy County Nebraska Sales Tax Rate The current total local sales tax rate in sarpy county, ne is 5.500%. current local sales and use tax rates and other sales and use tax information find the current and upcoming local sales and use tax rates for different jurisdictions in nebraska. The december 2020 total local. the minimum combined 2024 sales tax rate for sarpy,. Sarpy County Nebraska Sales Tax Rate.

From www.realestate.com.au

12534 S 227th Circle, Gretna, NE 68028 Land for Sale Sarpy County Nebraska Sales Tax Rate Click for sales tax rates, 68028 sales tax calculator, and printable sales tax. The current total local sales tax rate in sarpy county, ne is 5.500%. The december 2020 total local. The state sales and use tax. the average cumulative sales tax rate in sarpy county, nebraska is 7.04% with a range that spans from 5.5% to 7.5%. . Sarpy County Nebraska Sales Tax Rate.